Make Tax Planning Your 2024 Business Growth Accelerator with Debra Taylor (Ep. 66)

There are 3 ways an advisor grows their business: retain and deepen relationships with existing clients. Deepen relationships, increase share of wallet, and attract new clients. Tax planning does all three. In this episode, Jack Martin interviews Debra Taylor, CPA, PFS, CDFA®, JD, renowned tax…

Time-Sensitive Tax Planning Tips for Q4 with Ed Slott, CPA (Ep. 35)

In this episode, Jack Martin sits down with Ed Slott to unpack the action items you need to assist your clients with their tax planning. Ed outlines how to approach clients with an efficient and value-packed plan while detailing how these opportunities benefit client loyalty and business growth.

How to Approach Taxes for Short and Long-Term Goals With Jeff Levine (Ep. 30)

This week, the Chief Planning Officer at Buckingham Wealth Partners, Jeff Levine, joins Jack Martin to unveil what to expect in 2022 to effectively plan and prepare your client taxes. Jeff also highlights critical considerations to lower your client’s long-term tax spending.

Tax Planning Solutions Made Easy For Advisors With Kevin Lozer, CFP® (Ep. 25)

Every advisor wants to find better tax planning solutions for their clients. Are you one of them? In this episode, Kevin Lozer, co-founder of Holistiplan, joins Jack Martin to share everything you need to know about Holistiplan. Kevin reveals how this tool allows advisors and…

Social Security & Medicare Summed Up In 35 Minutes with Mary Beth Franklin, CFP® (Ep. 21)

Subscribe Are you an advisor looking to better serve your clients around their Social Security and Medicare needs? If so, this week’s episode of The Breakthrough Advisor with Social Security expert Mary Beth Franklin is for you! Join today’s conversation and learn valuable tips and…

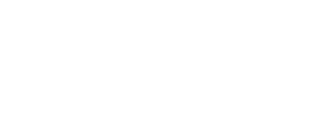

Retirement-Related Considerations from Retirement Expert Tom Hegna, CLU, ChFC, CASL (Ep. 20)

Subscribe While June is annuity awareness month, this week’s conversation goes beyond just annuities to encapsulate many other retirement-related components. In this episode, economist, author, and retirement expert Tom Hegna joins Jack Martin to break down valuable retirement considerations. Covering everything from retirement income and…

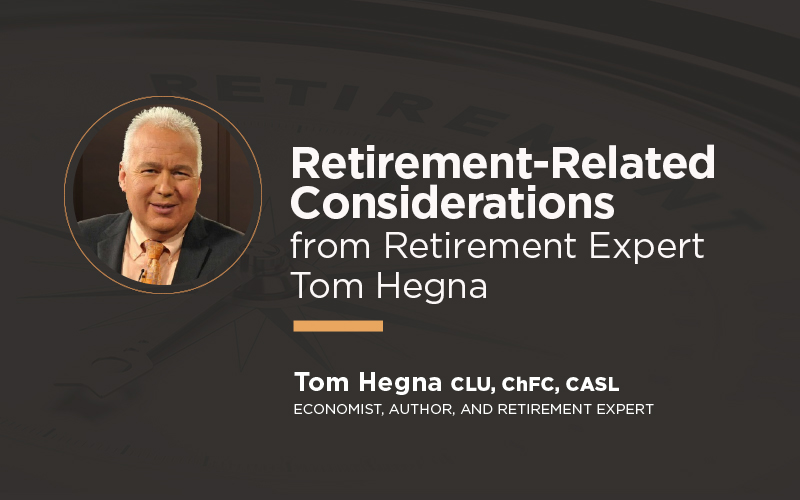

Protecting Clients’ Retirement Savings with Tax Planning — With Ed Slott, CPA (Ep. 17)

Subscribe Advisors, how are you helping your clients protect their retirement savings from unnecessary taxation? In today’s episode of The Breakthrough Advisor, join Ed Slott as he reveals ways he’s helping advisors lower their clients’ tax bill and protect what is likely clients’ biggest savings…

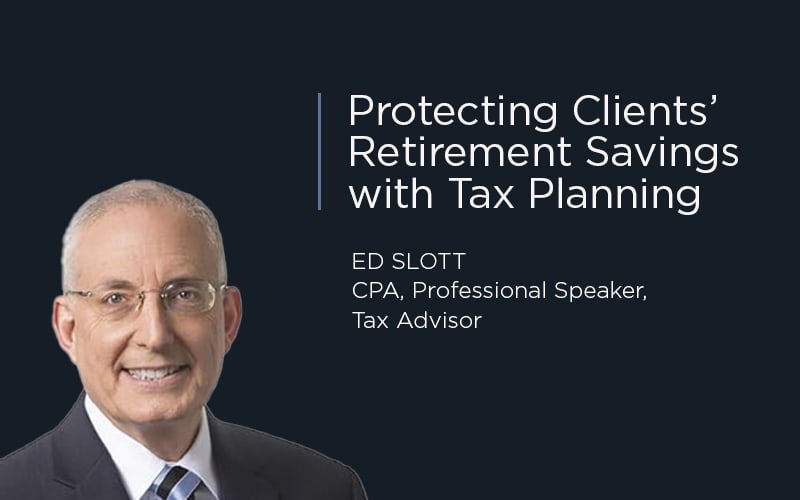

Building a Tax-Free Retirement – With Patrick Kelly (Ep. 12)

Bestselling author Patrick Kelly wants advisors and pre-retirees to realize that building a tax-free retirement is entirely possible. To achieve this, all you need to do is to work with an individual who fully understands the tax-free retirement strategy. In this episode, Patrick Kelly discusses…

How to Help Clients Plan for Asset-Based Long-Term Care – With Don Quante (Ep. 7)

Subscribe Advisors, what happens if your clients get sick? How can you help them pay for the care they need in the most tax- and cost-effective way? Today, Simplicity Asset-Based LTC’s Don Quante reveals a new way for advisors to think about long-term care advice….

What to Consider When Planning Your Retirement Income – With Wade Pfau (Ep. 4)

When planning for the income you’ll need for retirement, it can be difficult to determine which approach is best for you and your needs. To help you better understand your options, today’s episode of The Breakthrough Advisor features Wade D. Pfau, Ph.D., and professor of…