Four Boxes Advisors Should Check Off Their To-Do Lists in 2024

It’s a new year, and 2024 is chock full of opportunities for ambitious advisors who are willing to act strategically to capitalize on them. That’s right, this is not your generic New Year’s resolutions for advisors type of blog post. We’re talking about what’s going on now and steps financial professionals can take to make the most of the next 12 months.

No. 1: Make sure you focus on the things that clients value most (many advisors don’t).

Consider No. 1 on our list a bit of a flash back with a side of, it’s not about you, it’s about them. We’re flashing back to 2020 here and research from Morningstar that many advisors swept under the rug. The big takeaway, which was covered brilliantly and in detail in The Kitces Report, is that “Clients and advisors have different ideas about what is most important to clients.” Here’s how the two viewpoints compare (1 being most valuable, 5 being least):

CLIENTS

1). Helps me reach my financial goals

2). Has the relevant skills & knowledge

3). Communicates and explains financial

concepts well unbiased advice

4). Can help me maximize my returns

5). Has a good reputation, positive reviews

ADVISORS

1). Understands me and my unique needs

2). Helps me reach my financial goals

3). Keeps my interests in focus with

concepts well unbiased advice

4). Communicates and explains financial

concepts well

5). Has the relevant skills and knowledge

Why is this so important? If you want to turn a prospect into a client, you need to make sure the first two things they learn about you is that you can help them reach their financial goals and you have relevant skills and knowledge they can trust.

When they see your posts on social media, get an email from you, hear you speak in the media (podcast, TV show, radio show, webinar, etc.) and visit your website and LinkedIn profile, these top two items need to shine through. Items 3, 4 and 5 on the list come later in the advisor-client relationship.

ACTION ITEM: Take a deeper dive into the Morningstar research and get the how-tos in The Kitces Report’s original post.

No. 2: Taxes are on sale (for now)! Educate clients about steps to take to mitigate taxes in retirement

The 2017 Tax Cuts and Jobs Act (TCJA), which cut tax rates and increased the standard deduction for many Americans, is scheduled to expire at the end of 2025. As Kiplinger reports, once the TCJA sunsets many Americans could end up paying an additional 20% or more in taxes in 2026. Taxes are one of the biggest expenses Americans pay in retirement, so it is prudent for advisors to make tax planning a priority for clients before the TCJA expires.

Advisors have a golden opportunity to be a hero for their clients by helping them be proactive about paying taxes NOW when they’re lower, instead of later when they’re higher. For example, now is a great time for clients to roll over all or a portion of their traditional IRAs and 401ks into Roth IRAs. That means less taxes to pay in retirement and more income from investments over the long-term.

ACTION ITEM 1: Get more insight on tax planning from experts we’ve chatted up on our podcast and written about in our blog, then reach out to clients to discuss (individually and through your marketing channels):

- Ed Slott, CPA: Capitalize on Taxes and Inflation: 3-Year Window for Advisors (podcast) and The Make-or-Break Tax Talk Clients Need Now (blog)

- Chris Field, CGO, Holistiplan: Simplify and Demystify Tax Planning (podcast), Clients Desperately Need Help Demystifying Taxes: Are You Ready to Step Up? (blog)

ACTION ITEM 2: Simplify tax planning with Holistiplan! Just upload the client’s tax return, and in less than a minute you get personalized reports and talking points to review with your client.

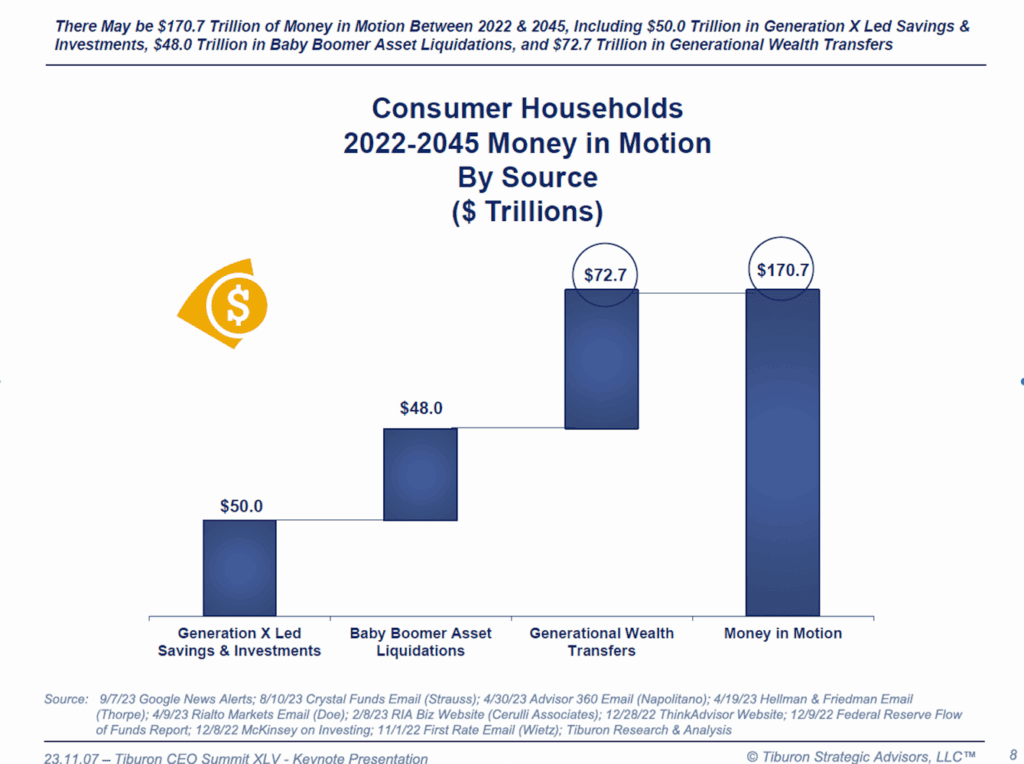

No. 3: Position yourself to capitalize on the Great Wealth Transfer.

We all know it’s coming … the $170+ trillion Tiburon estimates to be in motion from 2022 to 2045 (see chart). According to the ninth UBS Billionaire Ambitions Report 2023, that money in motion is already on the move. In fact, this is the first year in the report’s history that the majority of billionaires who accumulated wealth in the last year, did so through inheritance as opposed to entrepreneurship.

“This is a theme we expect to see more of over the next 20 years, as more than 1,000 billionaires pass an estimated USD 5.2 trillion to their children,” said Benjamin Cavalli, Head of Strategic Clients at UBS Global Wealth Management. UBS research also revealed that the billionaires and their heirs have very different views regarding their goals, values and risks.

It’s critical for advisors to get a solid handle on how the various generations differ in these viewpoints. That way they can position themselves as the best resource for the entire family. Too often, advisors only focus on the one family member—the primary decision maker. Advisors who want to serve all generations well will also need to work on building relationships with heirs, so they can offer solutions that address their unique needs and concerns.

ACTION ITEMS: Tap into the UBS Billionaire Ambitions Report 2023 mentioned above and check out our recent podcasts and blog that provide more info on this topic:

- Wealth Planning and Tax Planning Opportunities in 2024 podcast, with CPA Ed Slott.

- Navigating Uncertainty in Retirement podcast, with Michael Harris and Steve Gresham.

- Involving Family in Financial Planning Is Good for Clients and for Business blog.

No. 4: Amp up the digitization of your business with a focus on personalization.

If you’re an InsurMark advisor partner or you frequent our webinars, podcasts or blogs, you know we’re cuckoo about technology—and for good reason. Digital tools help financial professionals simplify, manage and grow their practices. Fintech also makes it easier for advisors to differentiate themselves and personalize interactions with clients.

Consider this stat: Our top advisors attribute 30.9% of their revenue growth to an integrated marketing strategy that combines a customized website tailored to their target market’s needs with SEO and other tools available through automated marketing platforms like Catalyst. In addition, according to BrightEdge Research:

- SEO generates 1000% more traffic than social media.

- Organic search generates 53% of website traffic, compared to paid search at 27% (also a great tool) and organic social search at 5%.

But wait, there’s more! According to Stephanie Bogan—a high-performance business coach, strategist and entrepreneur—advisors who learn how to effectively digitize and differentiate themselves can generally expect to deliver 3x-5x the value in terms of trust equity, consistency, reliability and actual efficiency. These are all attributes that elevate the customer experience, which is critical for advisors who want to reduce attrition and grow their businesses.

Finally, we talked a lot about the importance of personalization in our podcasts and blogs this past year because it has a huge impact on marketing ROI. It’s truly a gamechanger when it comes to business growth.

In a survey of marketers by Salesforce, 97% of respondents reported a measurable lift (ROI) from their personalization efforts. Research by Kibo Commerce, Monetate and Certona also revealed that “companies that leverage a personalization strategy across the entire customer lifecycle see higher ROI (300% or more) and are able to quickly pivot to meet changing customer behaviors.”

If you haven’t invested in digital tools and a personalization strategy, the time is now!

ACTION ITEMS: Reach out to us to learn more about the digital tools and fintech platforms that InsurMark’s top advisors use. You can also check out the following Breakthrough Advisor podcasts and blogs for additional insight:

- Address Client’s Scariest Wealth and Health Pain Points with Personalized Longevity Conversations podcast, with Genivity Founder and CEO Heather Holmes.

- Personalization: The Key to Longevity Conversations that Click blog.

- Differentiation and Digitization podcast with Stephanie Bogan and related blog.

Need a marketing partner to help set your advisor practice up for success in 2024?

Contact us! To learn more about InsurMark and how we can help simplify, manage and grow your business, contact our office toll-free at (800) 752-0207 or connect with us online.

As an ADO – Advisor Development Organization™, InsurMark provides solutions to meet the ever-evolving needs of financial professionals with a mission to protect and enhance the financial security of every home in America.